Take control of the entire SETC Tax Refund Process with our proprietary tax transcript retrieval and document recreation system

See how you can increase profits, lower costs, reduce staffing, and simplify the entire process!

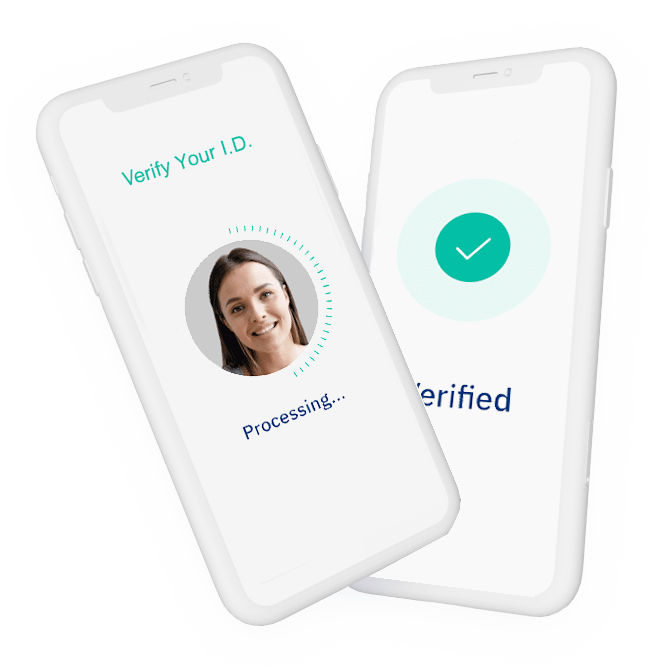

Tax Transcript Express (TTE) is an innovative solution designed to streamline the process of obtaining tax transcripts for your clients. By utilizing advanced technologies such as face scan ID validation and e-signature, TTE simplifies and accelerates the entire process. This not only reduces the turnaround time to just a few days but also eliminates the need for extensive back-and-forth communication, saving you time and money. With TTE, you can quickly and accurately determine your clients’ eligibility and refund amounts, enhancing your efficiency and client satisfaction.

We've kept the process super-simple for both you and your clients with no added upfront costs.

Our team is here to help and support you and your business every step of the way including support for your clients.

We meet all government mandated security standards for I.D Technology and facial scanning.

“This old process is time-consuming, costly, and ineffective. Your team is frustrated, and customers lose faith in your ability to deliver.”

You’ve been chasing customers for two years’ worth of tax returns, only to face endless hurdles:

Customers don't have time or can't reach their CPA.

They send images of documents piece by piece, often with missing pages.

Average wait time for complete documentation is over two weeks.

Numerous follow-up calls, high costs, excessive manpower, and confusion between sales, processing teams, and CPAs.

Determining qualifications requires additional staffing to review extensive documentation

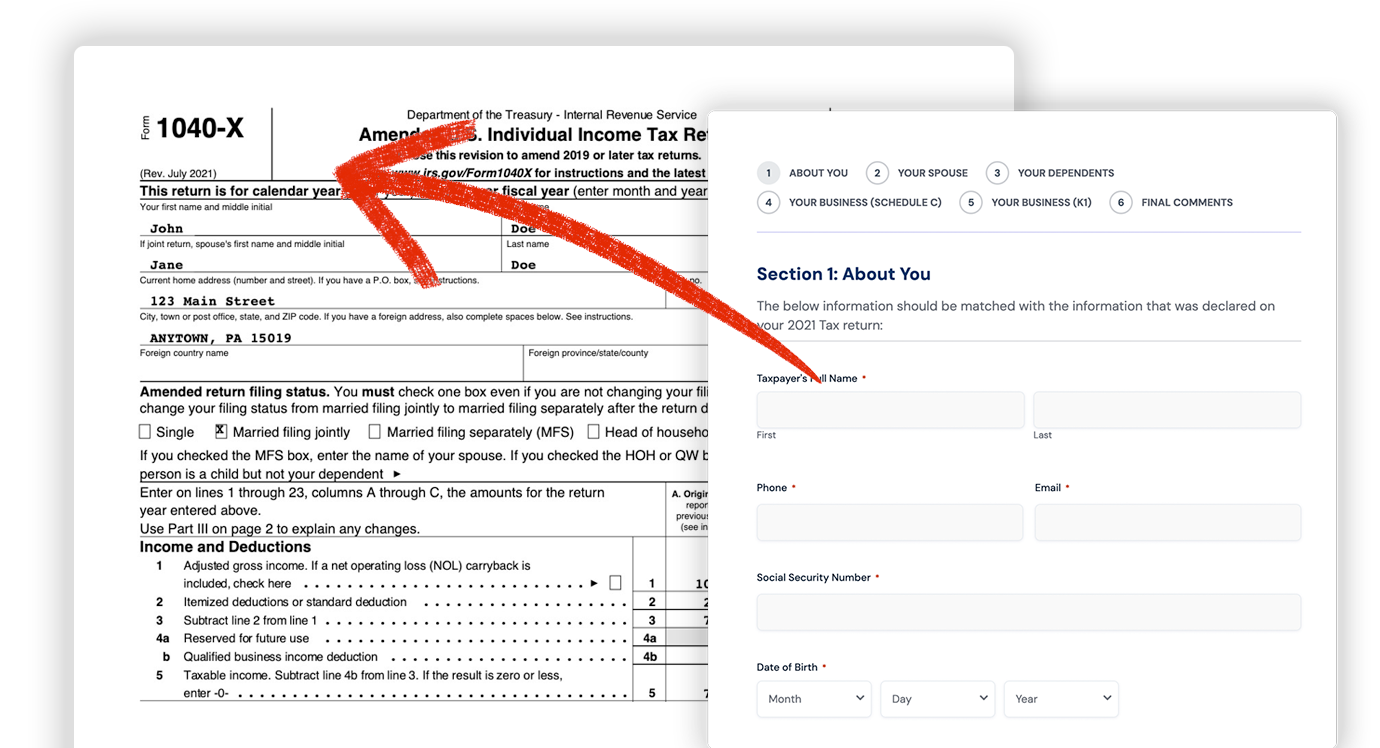

Processing final forms like 1040X & 7202 involves frustrating back-and-forth communication.

“By adopting our technology, you’re not just improving your SETC processing – you’re making a strategic investment in your business’s future.”

Imagine a world where obtaining and processing customer tax information is seamless and efficient. Our innovative technology revolutionizes the way you handle SETC:

Utilizing face scan technology for quick and secure identity verification.

Obtain full tax transcripts using Form 8821 with eSignature.

Customers feel obligated to validate and qualify themselves, shifting the control to you.

Receive complete and accurate tax returns in just 1-5 days.

Instantly know if a customer qualifies for SETC with precise qualification amounts.

We have literally redesigned the online processing system to help you complete the application process in a matter of minutes not days, weeks, or months!

In fact, by using Tax Transcripts Express you will see how you are about to get 3 out of 4 website visitors to sign up for your service and most importantly your new clients will provide you with all of the necessary tax documents you need within 5 minutes of them jumping onto your website!

Tax Transcript Express created this new solution by solving the three major problems you face when processing SETC applications manually and we consider these game changing services for your business:

Using our proprietary online software and Face scan technology for ID validation and e-signature, you can provide consent and authorization to Obtain a Full Tax Transcript directly from the IRS.

Your processing is made easy with our One Click Verification & Document Creation using technology to order Full Tax Transcripts and create all tax documents needed to submit your final SETC Application.

You can now create complete packages at the push of a button with our Proprietary TTE 1040X & 7202 Document Creator.

Our company has a proven track record of generating over $34 million in tax credit refunds, serving more than 4,000 satisfied clients. We were among the pioneers in processing the FFCRA programs when COVID-19 impacted American businesses in 2020, and we have been dedicated to supporting small businesses across America ever since.

We understand the challenges you face because we have encountered and overcome them ourselves. We have mastered the SETC program, ensuring success through expert lead generation, CRM management, processing, and tracking.

Our commitment is to assist as many American small business owners and independent contractors as possible before time runs out. We believe in win-win opportunities, and that’s why we’re offering you the right tools at the right time to achieve significant success. We’ve transformed our business for the better, and we are confident we can help you transform yours too.

TTE 1040X & 7202 Creator: Generate a complete, IRS-ready 1040X & 7202 with tax transcript.

Below you’ll find some of our most frequently asked questions regarding our company and the services we provide.

We have experienced the challenges and frustrations of the traditional method of obtaining clients’ documents. The process was inefficient and cumbersome, and we knew it needed improvement. That’s why we reinvented it with TTE.

With our new approach, clients simply follow straightforward steps to provide consent and authorization for us to pull their full tax transcripts. This allows you to quickly and easily confirm their eligibility and determine the amount of their SETC refund in just a few days, rather than months.

We have removed the hard work, pain, and follow-up from the process, making it easy and efficient for both you and your clients.

That’s a great question, and the answer comes down to costs. We found that 37% of the potential clients we spoke with were either unqualified or didn’t file taxes in 2020 and 2021, making them ineligible. This results in a significant waste of time and money to determine they aren’t suitable clients. Other companies charge $30-$50 on average, providing many unnecessary documents, leading to even more wasted expenses.

Tax Transcript Express (TTE) is an innovative solution designed to streamline the process of obtaining tax transcripts for your clients. By utilizing advanced technologies such as face scan ID validation and e-signature, TTE simplifies and accelerates the entire process. This not only reduces the turnaround time to just a few days but also eliminates the need for extensive back-and-forth communication, saving you time and money. With TTE, you can quickly and accurately determine your clients’ eligibility and refund amounts, enhancing your efficiency and client satisfaction.

At Tax Transcript Express, we prioritize the security and confidentiality of your clients’ information. Our platform uses state-of-the-art encryption and secure authentication methods, including face scan technology and e-signatures, to ensure that all data is protected at every step of the process. We comply with all relevant data protection regulations and continuously update our security protocols to guard against any potential threats. You can trust that your clients’ sensitive information is handled with the utmost care and security.

Tax Transcript Express offers a cost-effective solution compared to other services in the market. While other companies may charge $30-$50 on average and provide numerous unnecessary documents, TTE focuses on delivering exactly what you need. Our streamlined process eliminates the costs associated with handling ineligible clients and excessive documentation. By reducing wasted time and resources, TTE provides better value and efficiency, ensuring you only pay for the essential services required to confirm your clients’ eligibility and refund amounts.

Our Support Team is available 24 /7 to answer your questions and concerns.